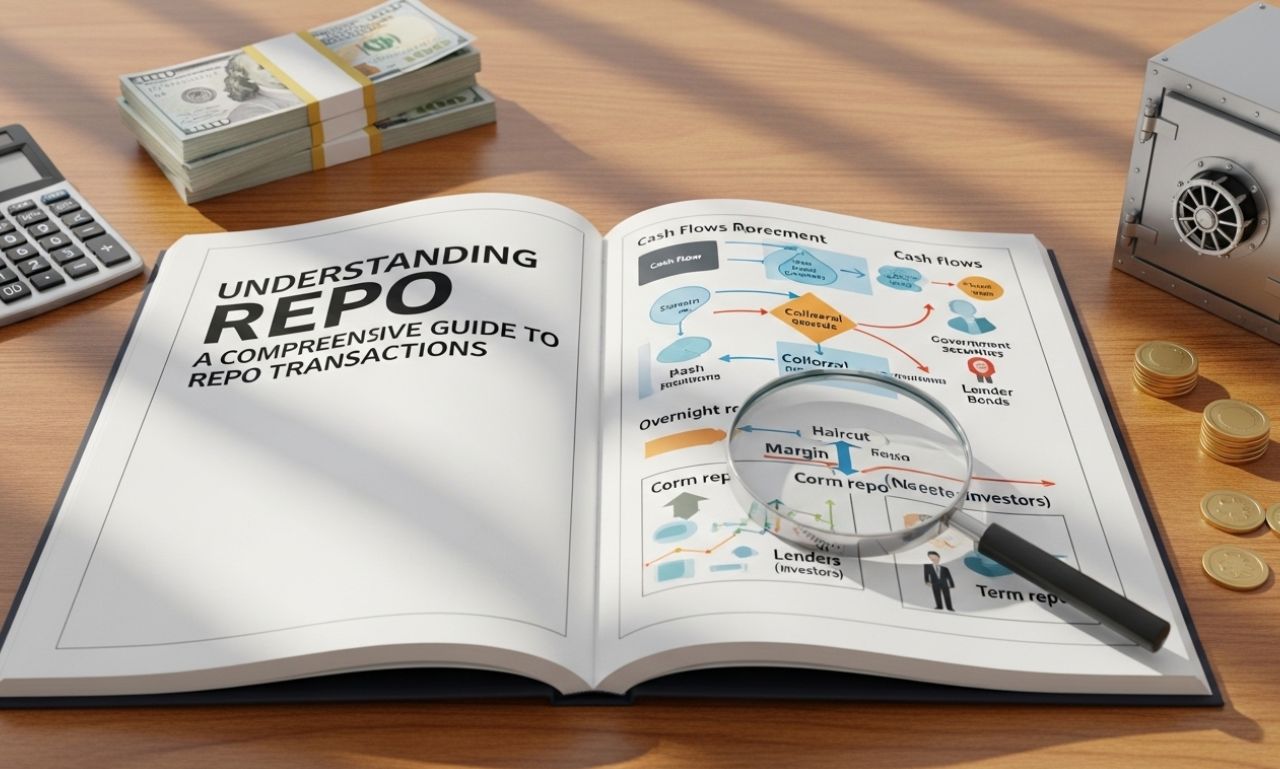

In the world of finance, the term repo is commonly used but often misunderstood. Short for “repurchase agreement,” a repo is a form of short-term borrowing, typically in government securities. One party sells securities to another with an agreement to repurchase them at a later date for a higher price. This mechanism is crucial for liquidity management in financial markets and serves as a reliable tool for both borrowers and lenders.

What Is a Repo?

A repo is essentially a collateralized loan. The seller of the security receives cash and agrees to repurchase the asset at a specified date and price. The difference between the sale price and the repurchase price represents the interest earned by the lender, known as the repo rate. Repos are widely used by banks, financial institutions, and central banks to manage short-term funding and maintain stability in the financial system.

Key features of a repo include:

-

Short-term nature, usually overnight or up to 30 days

-

Collateralized by high-quality securities, often government bonds

-

Low-risk investment for lenders due to collateral

Types of Repo

There are several types of repo transactions, each serving different purposes for market participants:

1. Overnight Repo

An overnight rep o is a short-term agreement where the securities are sold and repurchased the next day. It is commonly used by banks to manage daily liquidity needs.

2. Term Repo

A term re po extends for a specified period, usually more than one day but less than a year. This provides stability for both parties when longer-term liquidity management is required.

3. Open Repo

In an open rep o, there is no fixed repurchase date. The agreement remains open until either party decides to terminate it, offering flexibility in managing funds.

4. Reverse Repo

A reverse re po is the opposite of a re po transaction. Here, the buyer agrees to sell back the securities at a future date. Central banks often use reverse repos to absorb excess liquidity from the market.

How Repos Work

A typical repo transaction involves two parties: the cash borrower (seller of the securities) and the cash lender (buyer of the securities). The steps include:

-

The borrower sells securities to the lender for immediate cash.

-

Both parties agree on a repurchase date and price.

-

On the agreed date, the borrower repurchases the securities at the predetermined price.

The interest earned by the lender is called the re po rate, which reflects the cost of borrowing money using securities as collateral. The lower risk associated with r epo transactions makes them attractive for both banks and investors.

Benefits of Repo

R epo transactions provide several benefits for both financial institutions and the broader economy:

-

Liquidity Management: Banks can quickly access cash for short-term needs.

-

Low Risk: Collateralized nature minimizes credit risk for lenders.

-

Flexible Funding: Short- or long-term repos can be tailored to institutional needs.

-

Market Stability: Central banks use repos to regulate money supply and interest rates.

Risks Involved in Repo

While repo transactions are relatively safe, they are not entirely risk-free. Key risks include:

-

Counterparty Risk: The seller may default and fail to repurchase the securities.

-

Market Risk: Decline in collateral value may affect the lender if the borrower defaults.

-

Liquidity Risk: In a financial crisis, liquidating collateral quickly may be challenging.

Proper risk assessment and regulatory oversight are essential to mitigate these risks and maintain a healthy rep o market.

Repo Market and Its Importance

The re po market plays a vital role in the financial system. It allows banks and financial institutions to:

-

Meet daily cash requirements

-

Fund trading activities

-

Hedge interest rate risks

-

Maintain compliance with regulatory liquidity ratios

Central banks also rely on re po operations to conduct monetary policy. By adjusting r epo rates, they influence short-term interest rates and liquidity levels in the economy.

Repo Rate Explained

The re po rate is the interest rate charged on r epo transactions. It acts as a benchmark for short-term borrowing and lending in the financial markets. A lower re po rate encourages borrowing and liquidity injection, while a higher rate discourages borrowing to control inflation.

Real-World Examples of Repo

-

Central Bank Operations: Central banks often conduct r epo auctions to inject liquidity into the banking system.

-

Bank Borrowing: Commercial banks use re pos to fund daily operations without selling assets permanently.

-

Investment Funds: Hedge funds and money market funds invest in re pos for low-risk returns.

Conclusion

A re po is a cornerstone of modern finance, offering a safe, flexible, and efficient way to manage short-term liquidity. Whether used by central banks, commercial banks, or investment funds, re pos facilitate smooth functioning of financial markets. Understanding re po transactions, their types, benefits, and risks is crucial for anyone navigating the world of finance.