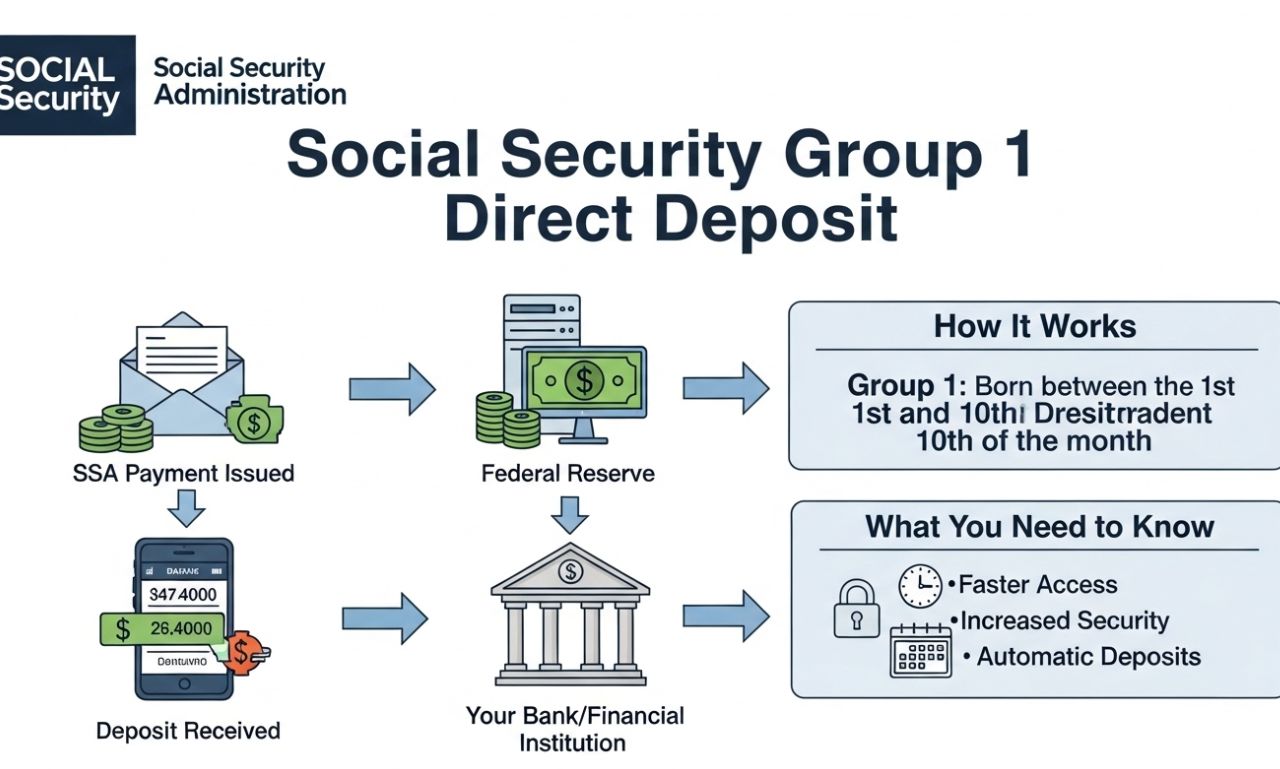

Social Security benefits are an essential part of financial planning for millions of Americans. For many recipients, Social Security Group 1 direct deposit is the most convenient and secure way to receive these payments. This system ensures that eligible beneficiaries have their funds deposited directly into their bank accounts, eliminating the need for paper checks and offering faster access to their benefits. In this article, we will explore everything you need to know about Social Security Group 1 direct deposit, including eligibility, how to set it up, and key benefits.

What is Social Security Group 1 Direct Deposit?

Social Security Group 1 direct deposit refers to the electronic transfer of benefits for individuals classified under Group 1 by the Social Security Administration (SSA). The SSA categorizes beneficiaries into groups to streamline payments and schedules. Group 1 typically includes recipients whose birthdays fall on the 1st through 10th of the month. This categorization helps the SSA organize direct deposit schedules efficiently, ensuring a smooth distribution of payments.

Direct deposit is a secure and reliable way to receive your benefits. Instead of waiting for a paper check in the mail, your Social Security payment is automatically transferred to your chosen bank account on a predetermined date. This system reduces the risk of lost or stolen checks and provides timely access to funds.

Eligibility for Social Security Group 1 Direct Deposit

To receive payments through Social Security Group 1 direct de posit, beneficiaries must meet specific criteria:

-

Enrollment in Social Security: You must be a Social Security beneficiary, either through retirement, disability, or survivor benefits.

-

Bank Account Requirement: Direct deposit requires an active checking or savings account at a U.S. financial institution.

-

Group 1 Classification: Your payment group depends on your birth date, with Group 1 covering the 1st through 10th of the month.

-

Consent for Direct Deposit: You must authorize the SSA to deposit your benefits electronically.

Once these conditions are met, your Social Security payments can be set up for direct deposit, ensuring that funds are delivered safely and on schedule.

How to Set Up Social Security Group 1 Direct Deposit

Setting up Social Security Group 1 direct de posit is a straightforward process. Follow these steps to ensure your benefits are delivered seamlessly:

-

Gather Your Banking Information: You will need your bank account number, routing number, and account type (checking or savings).

-

Complete Form SSA-1199: This form authorizes the SSA to deposit your benefits directly into your account. It can be obtained from the SSA website or local offices.

-

Submit Your Application: You can submit the completed form online via the SSA website, by mail, or in person at your local Social Security office.

-

Confirmation: After submission, the SSA will send a confirmation, and your first direct deposit typically occurs within one or two payment cycles.

It is important to double-check your bank details to avoid delays or errors in receiving your benefits.

Payment Schedule for Social Security Group 1 direct deposit

The Social Security Administration has a structured payment schedule to manage Group 1 benefits. Payments for Group 1 are generally made on the second, third, or fourth Wednesday of each month, depending on the month and year. The SSA follows a predictable schedule to ensure beneficiaries know exactly when to expect their funds.

Direct deposit guarantees that funds are available in your account on the payment date, even if it falls on a holiday or weekend. This reliability is one of the main advantages of electronic payments over paper checks.

Advantages of Social Security Group 1 Direct Deposit

Using direct deposit for Social Security payments provides several benefits:

-

Security: Eliminates the risk of lost or stolen checks.

-

Convenience: Funds are automatically deposited into your account without the need to visit a bank.

-

Faster Access: Payments are available on the scheduled date, even if mail delivery is delayed.

-

Environmentally Friendly: Reduces the use of paper checks.

-

Error Reduction: Minimizes delays caused by misprinted or lost checks.

These advantages make direct deposit the preferred method for most Social Security beneficiaries.

Common Questions About

Q1: Can I change my direct deposit account?

Yes, beneficiaries can update their bank account information at any time by submitting a new SSA-1199 form.

Q2: What happens if my bank account is closed?

You should notify the SSA immediately to provide a new account. Failure to do so may result in delayed or returned payments.

Q3: Can I still receive paper checks?

While paper checks are still an option, the SSA strongly encourages direct deposit due to its security and efficiency.

Q4: How soon will I receive my first direct deposit?

Typically, it takes one to two payment cycles after setting up direct deposit for the first payment to arrive.

Tips for Managing Your Social Security Direct Deposit

-

Monitor Your Account Regularly: Keep an eye on your bank statements to ensure all payments are received correctly.

-

Set Up Alerts: Many banks offer notifications when funds are deposited. This helps you stay informed.

-

Keep Your Bank Information Updated: Ensure your account details are current to avoid delays.

-

Plan Your Budget Around Payment Dates: Knowing your payment schedule allows better financial planning.

By following these tips, you can maximize the benefits of direct deposit and avoid common issues.

Conclusion

Social Security Group 1 direct de posit offers a secure, convenient, and timely way to receive your Social Security benefits. By understanding eligibility requirements, following the setup process, and managing your account responsibly, you can enjoy a seamless payment experience. Direct deposit not only saves time but also enhances security and reliability, making it the preferred choice for millions of Americans.

Whether you are a new beneficiary or looking to switch from paper checks, enrolling in Social Security Group 1 direct de posit is a smart move toward efficient financial management.