The USD to IN R exchange rate is a key indicator for businesses, travelers, investors, and anyone dealing with international finance. Understanding the conversion from United States Dollars (USD) to Indian Rupees (INR) helps make informed decisions in trade, travel, and online transactions. This guide explains how USD to INR works, factors affecting it, and tips for converting currency efficiently.

What Is USD to INR?

Understanding USD

The United States Dollar (USD) is the world’s primary reserve currency, widely used in global trade, investments, and financial markets.

Understanding INR

The Indian Rupee (IN R) is India’s official currency, regulated by the Reserve Bank of India (RBI). It is used for all domestic transactions, banking, and international trade.

How USD to INR Conversion Works

USD to IN R represents the value of one US dollar in Indian rupees. For example, if 1 USD = 83 IN R, converting dollars to rupees becomes straightforward. The exchange rate fluctuates based on economic, political, and market factors.

How to Check USD to INR Rates

Online Currency Converters

Websites like XE, OANDA, and Google Finance provide real-time USD to IN R rates.

Mobile Apps

Apps such as XE Currency and PayPal help track live conversion rates and historical trends.

Banks and Forex Services

Banks offer official USD to INR conversion rates for cash exchange and online transfers. Rates may vary due to fees or commissions.

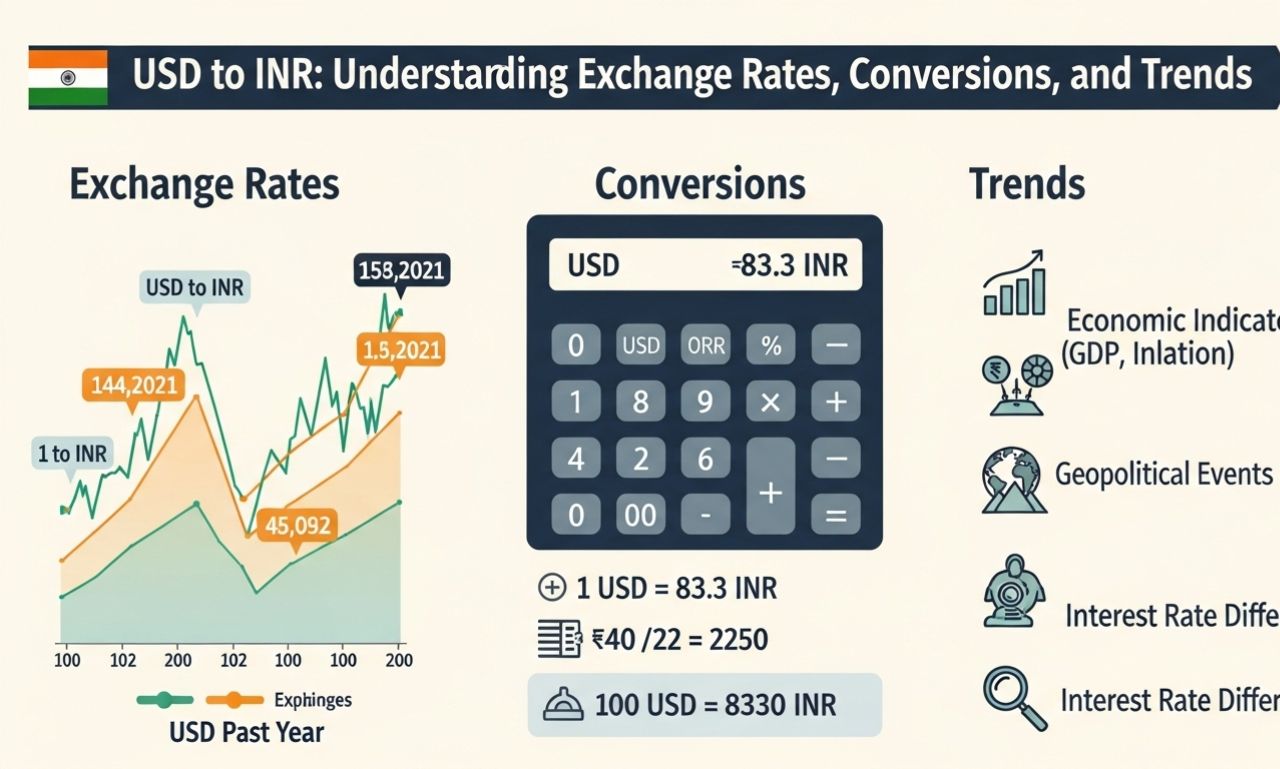

Factors Affecting USD to INR

-

Economic Indicators: GDP, inflation, and trade balance impact currency value.

-

Supply and Demand: High demand for USD increases its value against IN R.

-

Global Events: Political or economic events can influence exchange rates.

-

RBI Policies: Reserve Bank interventions, currency reserves, and interest rates affect the IN R.

How to Convert USD to INR

Conversion Formula

Amount in IN R=Amount in USD×USD to INR Rate\text{Amount in INR} = \text{Amount in USD} \times \text{USD to INR Rate}

Example:

-

100 USD × 83 = 8,300 IN R

-

50 USD × 83 = 4,150 IN R

Using Online Tools

Currency converters provide instant conversion based on current rates.

Using Banks

Banks provide secure conversion services, though rates may include slight variations.

Importance of USD to INR

Travel

Travelers need USD to IN R conversions to budget for flights, hotels, and local expenses.

Online Shopping

Many international e-commerce platforms require USD to IN R conversion to understand actual costs.

Business and Trade

Importers and exporters rely on USD to IN R for invoices, profits, and cost calculations.

Forex Trading

Traders monitor USD to IN R fluctuations to buy or sell currency in the foreign exchange market.

Tips for Getting the Best USD to INR Rate

-

Compare Rates: Check multiple banks or currency services.

-

Monitor Daily Changes: Rates fluctuate, so timing matters.

-

Set Alerts: Use apps to notify when rates reach favorable levels.

-

Avoid Airport Exchanges: They often have higher fees and lower rates.

Historical Trends of USD to INR

USD to IN R has varied over decades due to economic policies, inflation, and global market trends. Historically, IN R has ranged from approximately 40–85 per USD, reflecting changing economic conditions. Tracking these trends helps make informed financial decisions.

Conclusion

Understanding USD to IN R is essential for travelers, businesses, and investors. By staying updated on rates, using reliable conversion tools, and monitoring trends, you can make smarter financial decisions. Accurate knowledge of USD to IN R helps with budgeting, trading, and managing international transactions efficiently.